Amsterdam, the Netherlands – argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases, today announced its first quarter 2023 financial results and provided a business update.

“Throughout the first quarter, we made significant progress advancing our mission to redefine what well-controlled means in the treatment of autoimmune diseases. Our team remains focused on continued expansion within gMG with our planned launch of SC efgartigimod and upcoming global regulatory approvals, and the key pivotal data readouts we expect starting first with efgartigimod in CIDP and ARGX-117 in MMN,” said Tim Van Hauwermeiren, Chief Executive Officer of argenx. “We have an exciting year ahead as we grow VYVGART as a new standard of care in gMG, leverage its potential in other indications and progress our broader immunology pipeline, all of which brings us one step closer to achieving our goals and innovating on behalf of patients.”

FIRST QUARTER 2023 AND RECENT BUSINESS UPDATE

VYVGART Expansion

VYVGART is the first-and-only approved neonatal Fc receptor (FcRn) blocker in the U.S., Japan and the EU. argenx is planning for multi-dimensional expansion to reach more patients with VYVGART through additional regulatory approvals for generalized myasthenia gravis (gMG), the launch of SC efgartigimod for gMG, and new autoimmune indications with the VYVGART regulatory submission for immune thrombocytopenia (ITP) in Japan.

- Generated global net VYVGART sales of $218 million in the first quarter of 2023

- Regulatory reviews of SC efgartigimod for gMG ongoing in the U.S., EU and Japan

- Prescription Drug User Fee Act (PDUFA) target action date of June 20, 2023

- Marketing authorization application (MAA) filed in Japan in first quarter of 2023 with approval decision expected by first quarter of 2024

- MAA review underway by European Medicines Agency with approval decision expected in fourth quarter of 2023

- Received VYVGART approval from the UK Medicines and Healthcare products Regulatory Agency (MHRA) on March 15, 2023 and the State of Israel Ministry of Health on April 24, 2023 through Medison Pharma, marking both the fourth and fifth global approvals for gMG

- Pricing and reimbursement discussions ongoing in more than 10 countries in Europe

- Approval decisions expected in 2023 in Canada and in China through partnership with Zai Lab

Efgartigimod Research and Development

argenx aims to solidify its FcRn leadership by expanding the scope of IgG-mediated autoimmune diseases in development and further demonstrating the potential of FcRn blockade in ongoing clinical trials. By the end of 2023, efgartigimod is expected to be approved, in regulatory review or in development in 13 severe autoimmune diseases.

- ADHERE: Requisite events (88) achieved in trial for chronic inflammatory demyelinating polyneuropathy (CIDP); topline data now expected in July 2023

- ADDRESS: Enrollment complete in trial; topline data in pemphigus expected in fourth quarter of 2023

- ADVANCE-SC: Enrollment complete in trial; topline data from SC trial in ITP expected in fourth quarter of 2023

- BALLAD and ALKIVIA: Interim data in bullous pemphigoid expected in first half of 2024 and in myositis in second half of 2024

- ALPHA and RHO proof-of-concept (POC) trials underway through IQVIA collaboration in post- COVID-19 postural orthostatic tachycardia syndrome (PC-POTS) and primary Sjogren’s syndrome; topline data from ALPHA expected in fourth quarter of 2023

- POC trials underway in membranous nephropathy and lupus nephritis through Zai Lab collaboration

- Registrational trial in thyroid eye disease (TED) and POC trials in ANCA-associated vasculitis (ANCA) and antibody mediated rejection (AMR) in kidney transplant expected to start in fourth quarter of 2023

Pipeline Progress

argenx is advancing a robust portfolio of innovative clinical programs, including ARGX-117 (C2 inhibitor) and ARGX-119 (muscle-specific kinase (MuSK) agonist). Both programs have the potential to be first-in-class opportunities for multiple severe autoimmune indications.

- ARDA: Interim data from POC trial of ARGX-117 in multifocal motor neuropathy expected mid- 2023

- POC trial of ARGX-117 for prevention of delayed graft function after kidney transplantation expected to start in second half of 2023 following regulatory discussions

- Phase 1 dose-escalation trial of ARGX-119 in healthy volunteers ongoing; subsequent Phase 1b trial to assess early signal detection in patients with congenital myasthenic syndrome

Continued investment in Immunology Innovation Program (IIP) to broaden autoimmune pipeline for sustained value creation opportunities

- argenx continues to invest in its discovery engine, the Immunology Innovation Program, to foster a robust innovation ecosystem and drive early-stage pipeline growth. argenx expects to nominate one new development candidate in 2023.

- OncoVerity, an asset-centric spin-off company created with the University of Colorado Anschutz Medical Campus and UCHealth, announced the licensing of cusatuzumab, a first-in- class anti-CD70 antibody; argenx provided funding to advance OncoVerity to next phase of development

- Entered multiyear collaboration with Genmab to jointly discover, develop and commercialize antibody therapies; initial two targets identified within immunology and cancer

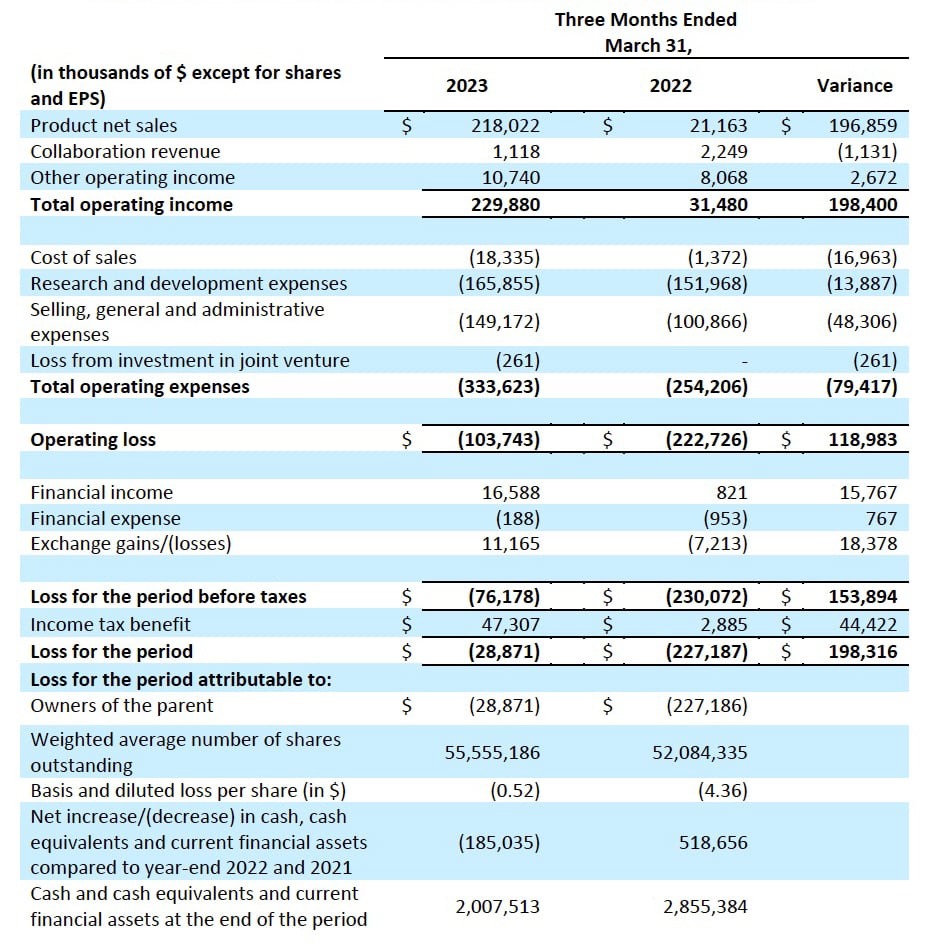

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENT OF PROFIT OR LOSS

DETAILS OF THE FINANCIAL RESULTS

Total operating income for the three months ended March 31, 2023 was $229.9 million, compared to

$31.5 million for the same period in 2022, and consists of:

- Product net sales from the sales of VYVGART for the three months ended March 31, 2023 were $218.0 million, compared to $21.2 million for the same period in 2022

- Collaboration revenue for the three months ended March 31, 2023 was $1.1 million, compared to $2.2 million for the same period in 2022. The collaboration revenue for the three months ended March 31, 2023 primarily relates to the clinical and commercial supply of efgartigimod to Zai Lab.

- Other operating income for the three months ended March 31, 2023 was $10.7 million, compared to $8.1 million for the same period in 2022. The other operating income for the three months ended March 31, 2023 primary relates to research and development tax incentives and payroll tax rebates.

Total operating expenses for the three months ended March 31, 2023 were $333.6 million, compared to $254.2 million for the same period in 2022, and consists of:

- Cost of sales for the three months ended March 31, 2023 was $18.9 million, compared to $1.4 million for the same period in 2022.

- Research and development expenses increased by $13.9 million for three months ended March 31, 2023 to $165.9 million, compared to $152 million for the same period in 2022. The research and development expenses mainly relate to external research and development expenses and personnel expenses incurred in the clinical development of efgartigimod in various indications and the expansion of other clinical and preclinical pipeline candidates.

- Selling, general and administrative expenses for the three months ended March 31, 2023 were $149.2 million, compared to $100.9 million for the same period in 2022. The selling, general and administrative expenses mainly relate to professional and marketing fees linked to commercialization of VYVGART in the U.S., Japan and the EU and personnel expenses.

- Loss from investment in joint venture for the three months ended March 31, 2023 was $0.3 million. The loss recognized was argenx’s share of losses in OncoVerity, Inc. There were no losses from investment in joint venture in the same period in 2022.

Financial income for the three months ended March 31, 2023 was $16.6 million, compared to $0.8 for the same period in 2022. The increase in financial income is mainly due to an increase in interest income on current financial assets and cash and cash equivalents attributable to higher interest rates.

Exchange gains/losses for the three months ended March 31, 2023 were $11.2 million of exchange gains, compared to $7.2 million exchange losses for the same period in 2022. Exchange gains are mainly attributable to unrealized exchange rate gains or losses on the cash, cash equivalents and current financial assets position in Euro.

Income tax for the three months ended March 31, 2023 was $47.3 million of tax benefit, compared to $2.9 million of tax benefit for the same period in 2022. Tax benefit for the three months ended March 31, 2023 consists of $10.8 million of income tax expense and $58.0 million of deferred tax income, compared to $5.0 million of income tax expense and $7.9 million of deferred tax income for the comparable prior period.

Net loss for the three months ended March 31, 2023 was $28,9 million, compared to $227.2 million for the comparable prior year period. On a per weighted average share basis, the net loss was $0.52 and $4.36 for the three months ended March 31, 2023 and 2022, respectively.

Cash, cash equivalents and current financial assets totaled $2.0 billion as of March 31, 2023, compared to $2.2 billion as of December 31, 2022. Cash and cash equivalents and current financial assets decreased primarily as a result from net cash flows used in operating activities.

FINANCIAL GUIDANCE

Based on current plans to fund anticipated operating expenses, working capital and capital expenditures, argenx expects to utilize up to $500 million of cash in 2023.

EXPECTED 2023 FINANCIAL CALENDAR

- July 27, 2023: HY 2023 financial results and business update

- October 26, 2023: Q3 2023 financial results and business update

CONFERENCE CALL DETAILS

The first quarter 2023 financial results and business update will be discussed during a conference call and webcast presentation today at 2:30 pm CET/8:30 am ET. A webcast of the live call may be accessed on the Investors section of the argenx website at argenx.com/investors. A replay of the webcast will be available on the argenx website.

Dial-in numbers:

Please dial in 15 minutes prior to the live call.

Belgium | 32 800 50 201 |

France | 33 800 943355 |

Netherlands | 31 20 795 1090 |

United Kingdom | 44 800 358 0970 |

United States | 1 888 415 4250 |

Japan | 81 3 4578 9752 |

Switzerland | 41 43 210 11 32 |

About argenx

argenx is a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases. Partnering with leading academic researchers through its Immunology Innovation Program (IIP), argenx aims to translate immunology breakthroughs into a world-class portfolio of novel antibody-based medicines. argenx developed and is commercializing the first-and- only approved neonatal Fc receptor (FcRn) blocker in the U.S., Japan, the EU and the UK. The Company is evaluating efgartigimod in multiple serious autoimmune diseases and advancing several earlier stage experimental medicines within its therapeutic franchises. For more information, visit www.argenx.com and follow us on LinkedIn, Twitter, and Instagram.

For further information, please contact:

Media:

Erin Murphy

emurphy@argenx.com

Investors:

Beth DelGiacco

bdelgiacco@argenx.com

Lynn Elton

lelton@argenx.com

Forward-looking Statements

The contents of this announcement include statements that are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “hope,” “estimates,” “anticipates,” “expects,” “intends,” “may,” “will,” or “should” and include statements argenx makes regarding its expansion strategy to reach more patients with VYVGART through additional regulatory approvals for generalized myasthenia gravis (gMG), the launch of SC efgartigimod for gMG, and new autoimmune indications with the VYVGART regulatory submission for immune thrombocytopenia (ITP) in Japan; pending regulatory reviews of SC efgartigimod for gMG in the U.S., EU and Japan; the Prescription Drug User Fee Act (PDUFA) target action date; the expected Japan Marketing Authorization Application (MAA) approval by the first quarter of 2024; the expected European Medicines Agency MAA approval in the fourth quarter of 2023; the expected approval decisions in Canada and through Zai Lab in China in 2023; its aim to solidify its Fc receptor (FcRn) leadership by expanding the scope of IgG- mediated autoimmune diseases in development and further demonstrating the potential of FcRn blockade in ongoing clinical trials; its expectation of being approved, in review, or in development in 13 autoimmune diseases by the end of 2023; its expectations about its pipeline progress; continued investment in its Immunology Innovation Program to broaden its pipeline for sustained value creation opportunities; its collaborations and their potential benefits; the therapeutic potential of its product candidates; the intended results of its strategy and its collaboration partners’, advancement of, and anticipated clinical development, data readouts and regulatory milestones and plans, including the timing of planned clinical trials and expected data readouts; the design of future clinical trials and the timing and outcome of regulatory filings and regulatory approvals; its expectation of utilizing up to $500 million cash in 2023; and its 2023 business and financial outlook and related plans. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual results may differ materially from those predicted by the forward-looking statements as a result of various important factors, including the effects of the COVID-19 pandemic, inflation and deflation and the corresponding fluctuations in interest rates; regional instability and conflicts, such as the conflict between Russia and Ukraine, argenx’s expectations regarding the inherent uncertainties associated with competitive developments, preclinical and clinical trial and product development activities and regulatory approval requirements; argenx’s reliance on collaborations with third parties; estimating the commercial potential of argenx’s product candidates; argenx’s ability to obtain and maintain protection of intellectual property for its technologies and drugs; argenx’s limited operating history; and argenx’s ability to obtain additional funding for operations and to complete the development and commercialization of its product candidates. A further list and description of these risks, uncertainties and other risks can be found in argenx’s U.S. Securities and Exchange Commission (SEC) filings and reports, including in argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no obligation to publicly update or revise the information in this press release, including any forward-looking statements, except as may be required by law.