argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases, today announced its half year 2022 financial results and provided a second quarter business update.

“We had a strong second quarter of our global VYVGART launch reflecting the significant need for effective, safe treatment options for people living with generalized myasthenia gravis and the unwavering commitment of our team to deliver our innovation to patients around the world. We are still in the early stages of our first commercial launch, but are encouraged by the initial clinical interest in our first-in-class FcRn blocker and the feedback we are hearing from patients and their supporters,” said Tim Van Hauwermeiren, Chief Executive Officer of argenx. “Based on our two positive Phase 3 data readouts already in 2022 and our plan to be active in 12 autoimmune indications by the end of the year across both efgartigimod and ARGX-117, we are confident that we are only at the beginning of our quest to transform the treatment of autoimmune disease.”

SECOND QUARTER 2022 AND RECENT BUSINESS UPDATE

VYVGART Launch Progress

VYVGART is the first-and-only approved neonatal Fc receptor (FcRn) blocker in the U.S. and Japan. VYVGART is approved in the U.S. for the treatment of adult generalized myasthenia gravis (gMG) patients who are anti-acetylcholine receptor (AChR) antibody positive and in Japan for adult gMG patients. The global launch strategy is on track to make VYVGART available in Europe, China and Canada, as well as select additional regions.

- Generated global net product revenues of $75 million for second quarter of VYVGART commercial launch in U.S. and Japan

- European Commission (EC) approval expected in third quarter 2022 following positive recommendation from Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA)

- Zai Lab and Medison filed for approval in China and Israel, respectively

- Entered into VYVGART commercial and distribution agreement with Medison in Central and Eastern Europe

Efgartigimod Research and Development

argenx is positioned to expand its leadership position in FcRn blockade to include ten total autoimmune indications by the end of 2022, including registrational trials in six indications and proof-of-concept trials in four indications across multiple therapeutic franchises.

- Neuromuscular franchise

- BLA for SC efgartigimod for gMG on track to be filed by end of 2022

- Topline data from registrational ADHERE trial of SC efgartigimod for chronic inflammatory demyelinating polyneuropathy (CIDP) expected in first quarter of 2023

- Registrational ALKIVIA trial of SC efgartigimod on track to start in third quarter of 2022 for three subtypes of idiopathic inflammatory myopathies (myositis), including immune-mediated necrotizing myopathy, anti-synthetase syndrome and dermatomyositis; interim analysis planned of first 30 patients of each subtype

- Hematology franchise

- Enrollment expanded in second registrational ADVANCE-SC trial of SC efgartigimod for primary immune thrombocytopenia (ITP) based on key learnings from positive ADVANCE-IV trial; topline data now expected in second half of 2023

- Dermatology franchise

- Topline data from registrational ADDRESS trial of SC efgartigimod for pemphigus vulgaris and foliaceus expected in second half of 2023

- Registrational BALLAD trial ongoing of SC efgartigimod for bullous pemphigoid with interim analysis planned of first 40 patients

- Proof-of-concept trials to launch in 2022 in collaboration with Zai Lab and IQVIA

- Zai Lab to launch Phase 2 trials in lupus nephritis and membranous nephropathy with argenx to lead global registrational programs for each potential indication

- IQVIA to launch Phase 2 trials in primary Sjogren’s syndrome and COVID-19-mediated postural orthostatic tachycardia syndrome (POTS)

Pipeline Progress

argenx is developing ARGX-117 and ARGX-119, which both have pipeline-in-a-product potential for multiple autoimmune indications.

- ARGX-117 (C2 inhibitor)

- Proof-of-concept ARDA trial ongoing to evaluate safety, tolerability, and potential dosing regimen in multifocal motor neuropathy (MMN)

- Phase 2 proof-of-concept trial expected to start in 2022 for prevention of delayed graft function and/or allograft failure after kidney transplantation

- ARGX-119 (muscle-specific kinase (MuSK) agonist)

- Phase 1 dose-escalation trial in healthy volunteers expected to start after Clinical Trial Application filing in fourth quarter of 2022 with subsequent Phase 1b trial to assess early signal detection in patients

Creation of OncoVerity

argenx, the University of Colorado Anschutz Medical Campus and UCHealth created an asset-centric spin-off, OncoVerity, Inc., focused on optimizing and advancing the development of cusatuzumab, a novel anti-CD70 antibody, in acute myeloid leukemia (AML). OncoVerity will be an entity of co-creation, combining the extensive translational biology insights from Dr. Clayton Smith, M.D. from the University of Colorado with the experience from argenx on the CD70/CD27 pathway. OncoVerity is the fourth spin-off company from argenx’s Immunology Innovation Program.

Nomination of Camilla Sylvest as non-executive director to Board of Directors

Ms. Sylvest’s appointment is pending approval, which is expected to occur at an extraordinary general meeting of shareholders to be held in September 2022. She is the Executive Vice President of Commercial Strategy and Corporate Affairs at Novo Nordisk, where she has worked for 26 years.

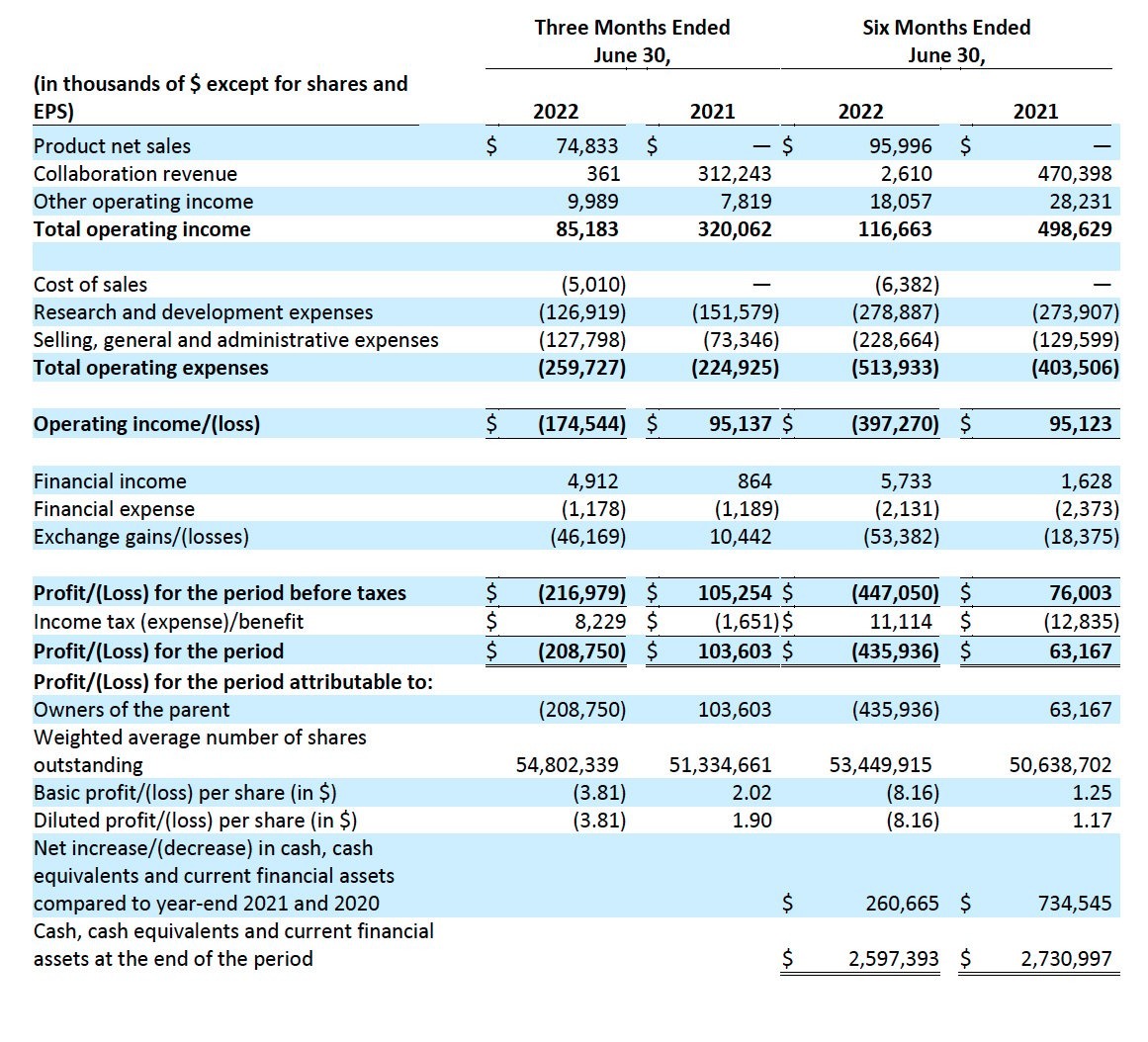

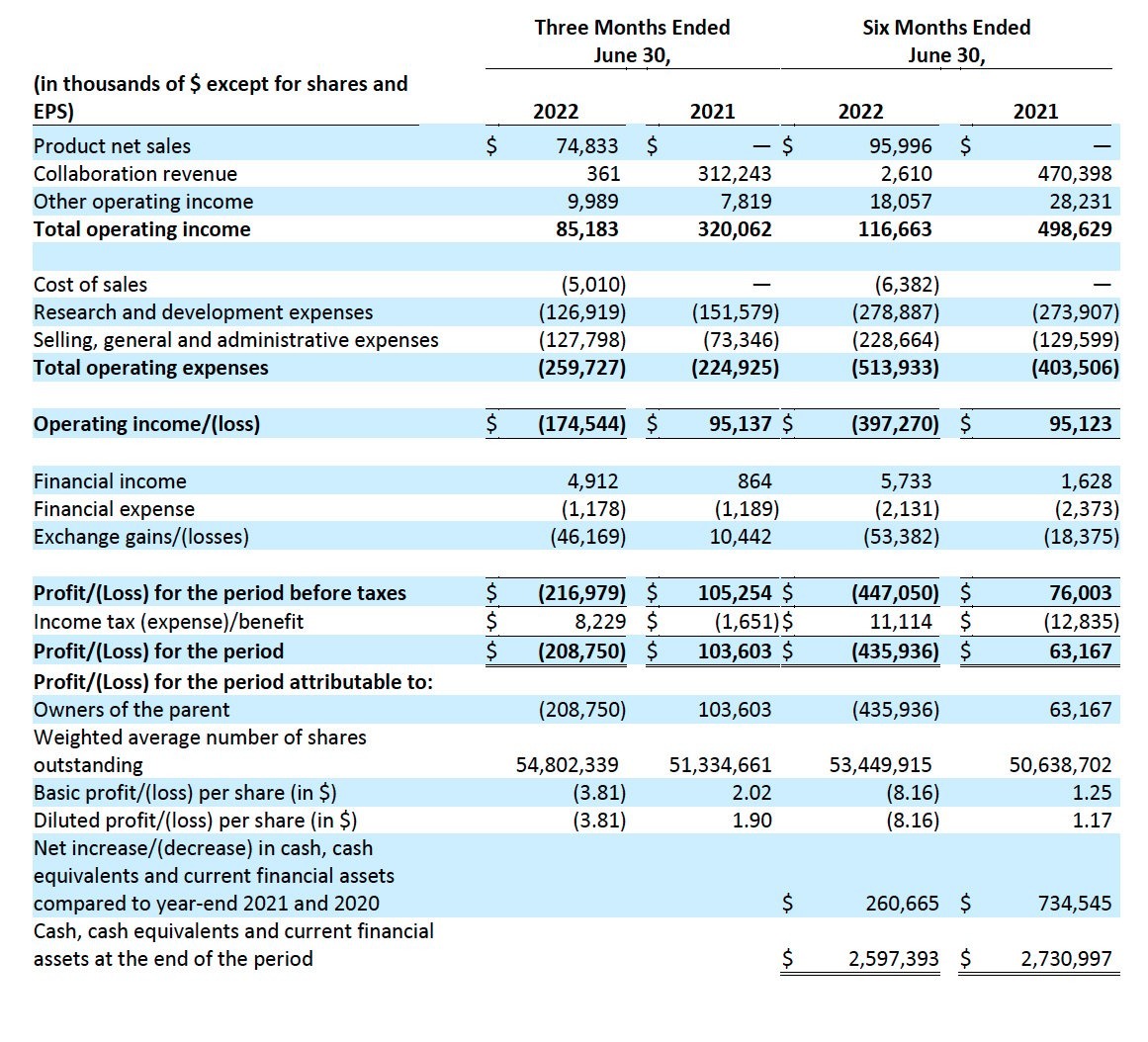

SECOND QUARTER 2022 FINANCIAL RESULTS

ARGENX SE

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENT OF PROFIT OR LOSS

DETAILS OF THE FINANCIAL RESULTS

Total operating income for the second quarter and year-to-date in 2022 was $85.2 million and $116.7 million, respectively, compared to $320.1 million and $498.6 million for the same periods in 2021, and consists of:

- Product net sales from the sales of VYVGART for the three months ended June 30, 2022 were $74.8 million compared to $21.2 million for three month ended March 31, 2022, following the approval of VYVGART by the U.S. Food and Drug Administration (FDA) on December 17, 2021 and Pharmaceuticals and Medical Devices Agency (PMDA) in Japan on January 20, 2022. No product net sales were recognized during the same period in 2021.

- Collaboration revenue for the second quarter and year-to-date in 2022 was $0.4 million and $2.6 million, respectively, compared to $312.2 million and $470.4 million for the same periods in 2021. The collaboration revenue for the three and six months ended June 30, 2021 was primarily attributable to the recognition of the transaction price as a consequence of the termination of the collaboration agreement with Janssen, resulting in the recognition of $311 million in collaboration revenue.

- Other operating income for the second quarter and year-to-date in 2022 was $10.0 million, and $18.1 million, respectively, compared to $7.8 million and $28.2 million for the same periods in 2021. During the three months ended June 30, 2022, the fair value of the argenx profit share in AgomAb Therapeutics NV increased by $4.3 million. The increase is a result of the extension of a Series B financing round by AgomAb for which the Company maintains a profit share in exchange for granting the license for the use of HGF-mimetic antibodies from the SIMPLE Antibody™ platform.

Total operating expenses for the second quarter and year-to-date in 2022 were $259.7 million and $513.9 million, respectively, compared to $224.9 million and $403.5 million for the same periods in 2021, and consists of:

- Cost of sales for the second quarter and year-to-date in 2022 was $5.0 million and $6.4 million, respectively. The cost of sales were recognized with respect to the sale of VYVGART during the first half of 2022. There were no cost of sales recognized in the comparable prior year periods.

- Research and development expenses for the second quarter and year-to-date in 2022 were $126.9 million and $278.9 million, respectively, compared to $151.6 million and $273.9 million for the same periods in 2021. The research and development expenses mainly relate to external research and development expenses and personnel expenses incurred in the clinical development of efgartigimod in various indications and the expansion of our other clinical and preclinical pipeline candidates.

- Selling, general and administrative expenses for the second quarter and year-to-date in 2022 were $127.8 million and $228.7 million, respectively, compared to $73.3 million and $129.6 million for the same periods in 2021. The selling, general and administrative expenses mainly relate to professional and marketing fees linked to the commercialization of VYVGART in the U.S. and Japan and personnel expenses.

Exchange losses for the second quarter and year-to-date in 2022 were $46.2 million and $53.4 million, respectively, compared to exchange gains of $10.4 million and exchange loss of $18.4 million for the same periods in 2021. Exchange losses are mainly attributable to unrealized exchange rate losses on our cash, cash equivalents and current financial assets position in Euro.

Income tax for the second quarter and year-to-date in 2022 was $8.2 million and $11.1 of tax income, respectively, compared to $1.7 million and $12.8 million of tax expense for the same periods in 2021. Tax income for the three months ended June 30, 2022 consists of $2.7 million of income tax expense and $10.9 million of deferred tax income, compared to $3.2 million of income tax expense and $1.5 million of deferred tax income for the same period in 2021.

Net loss for the second quarter and year-to-date in 2022 was $208.7 million and $435.9 million, respectively, compared to net profit of $103.6 million and $63.2 million for the same periods in 2021.

Cash, cash equivalents and current financial assets totaled $2,597.4 million as of June 30, 2022, compared to $2,336.7 million as of December 31, 2021. The increase in cash and cash equivalents and current financial assets resulted primarily from the closing of a global offering of shares, including a U.S. offering and a European private placement, which resulted in the receipt of $761.0 million in net proceeds in March 2022, partially offset by net cash flows used in operating activities.

FINANCIAL GUIDANCE

Based on current plans to fund anticipated operating expenses and capital expenditures, argenx continues to expect its 2022 cash burn to be up to $1 billion. This will support the global VYVGART launches, clinical development of efgartigimod in 10 indications and ARGX-117 in two indications, investment in the global supply chain, and continued focus on pipeline expansion through the Immunology Innovation Program.

EXPECTED 2022 FINANCIAL CALENDAR

- October 27, 2022: Q3 2022 financial results and business update

CONFERENCE CALL DETAILS

The half-year financial results and second quarter 2022 business update will be discussed during a conference call and webcast presentation today at 2:30 pm CEST/8:30 am ET. A webcast of the live call may be accessed on the Investors section of the argenx website at argenx.com/investors. A replay of the webcast will be available on the argenx website.

Dial-in numbers:

Please dial in 15 minutes prior to the live call.

| Belgium | 32 800 50 201 |

| France | 33 800 943355 |

| Netherlands | 31 20 795 1090 |

| United Kingdom | 44 800 358 0970 |

| United States | 1 888 415 4250 |

| Japan | 81 3 4578 9752 |

| Switzerland | 41 43 210 11 32 |

About argenx

argenx is a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases. Partnering with leading academic researchers through its Immunology Innovation Program (IIP), argenx aims to translate immunology breakthroughs into a world-class portfolio of novel antibody-based medicines. argenx developed and is commercializing the first-and-only approved neonatal Fc receptor (FcRn) blocker in the U.S. and Japan. The Company is evaluating efgartigimod in multiple serious autoimmune diseases and advancing several earlier stage experimental medicines within its therapeutic franchises. For more information, visit www.argenx.com and follow us on LinkedIn, Twitter, and Instagram.

For further information, please contact:

Media:

Kelsey Kirk

kkirk@argenx.com

Investors:

Beth DelGiacco

bdelgiacco@argenx.com

Forward-looking Statements

The contents of this announcement include statements that are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “hope,” “estimates,” “anticipates,” “expects,” “intends,” “may,” “will,” or “should” and include statements argenx makes regarding the VYVGART launch strategy to make VYVGART available in Europe, China, Canada and select other regions, the expected European Commission (EC) approval in the third quarter of 2022, Zai Lab and Medison’s respective pending approvals in China and Israel; its position to expand its leadership position in FcRn blockade to include ten autoimmune indications by the end of 2022; its expectations about its pipeline progress; its collaboration with the University of Colorado Anschutz Medical Campus and UCHealth to create OncoVerity, Inc.; the therapeutic potential of its product candidates; the intended results of its strategy and its collaboration partners’, advancement of, and anticipated clinical development, data readouts and regulatory milestones and plans, including the timing of planned clinical trials and expected data readouts; the design of future clinical trials and the timing and outcome of regulatory filings and regulatory approvals; its expectation that its 2022 cash burn will be up to $1 billion and the 2022 business and financial outlook and related plans. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual results may differ materially from those predicted by the forward-looking statements as a result of various important factors, including the effects of the COVID-19 pandemic, inflation and deflation and the corresponding fluctuations in interest rate; regional instability and conflicts, such as the conflict between Russia and Ukraine, argenx’s expectations regarding the inherent uncertainties associated with competitive developments, preclinical and clinical trial and product development activities and regulatory approval requirements; argenx’s reliance on collaborations with third parties; estimating the commercial potential of argenx’s product candidates; argenx’s ability to obtain and maintain protection of intellectual property for its technologies and drugs; argenx’s limited operating history; and argenx’s ability to obtain additional funding for operations and to complete the development and commercialization of its product candidates. A further list and description of these risks, uncertainties and other risks can be found in argenx’s U.S. Securities and Exchange Commission (SEC) filings and reports, including in argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no obligation to publicly update or revise the information in this press release, including any forward-looking statements, except as may be required by law.